The recovery in share prices that started in the first quarter of 2019 continued through the second quarter. This was in spite of a significant blip when Donald Trump tweeted that he was going to increase tariffs on Chinese imports from 10% to 25%. This bad news sent markets in a spin, due to the negative impact on global trade. This may be a negotiating tactic on his part, but Trump is damaging business and industry in his homeland, and upsetting investors at the same time. However, markets have since recovered as the mood-music between the US & China improved during the recent G20 meeting.

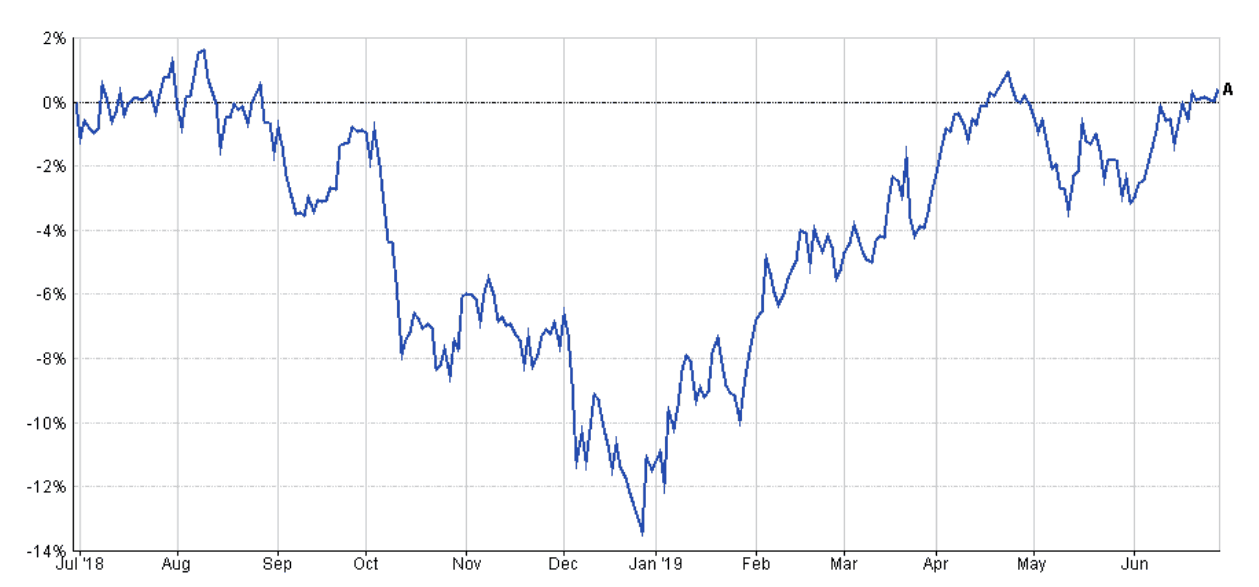

Investors are now broadly back to where they were before markets took fright in the Autumn of 2018.

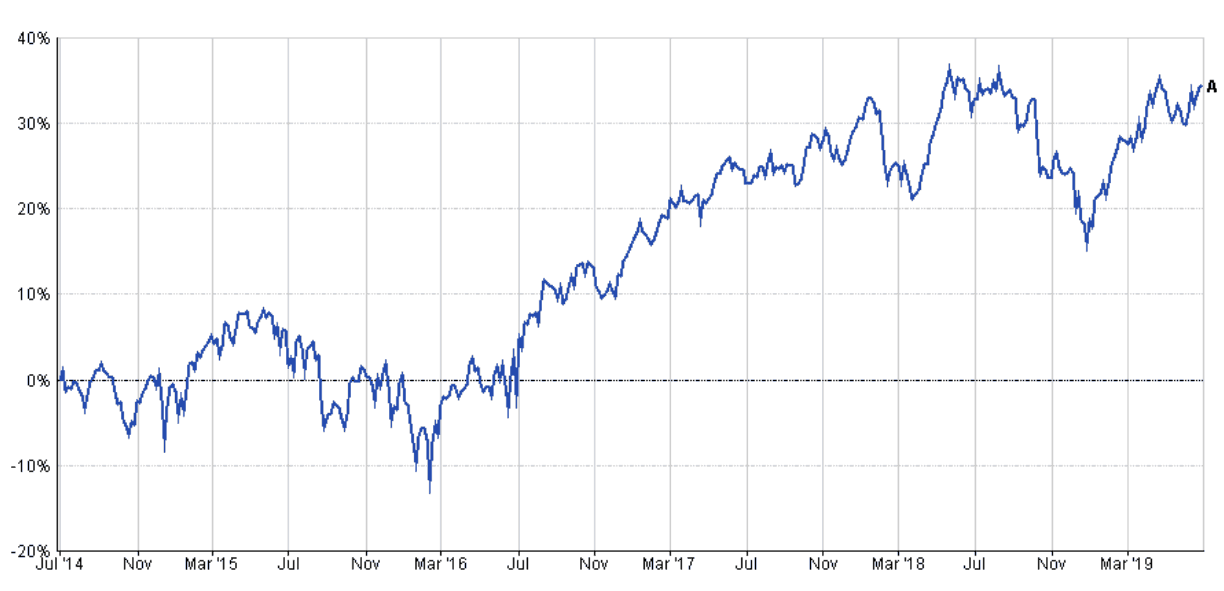

Here in the UK the domestic stock market has made steady progress this year. Whilst Brexit tensions continue the UK market has enjoyed steady returns, reflecting ongoing weakness in Sterling and the wider global optimism about economic prospects.

Other headlines of note were:

- A continued easing in global growth, especially in Europe, where the export of manufactured products to China has slowed as a knock-on effect of the US/China trade war.

- A trade deal between China and the US still seems a way off. Whilst there was some movement at the recent G20 meeting, there are still plenty of disagreements to be resolved.

- Here in the UK Brexit rumbles on and a general election or another referendum seems more likely. Sterling has weakened further since the Tory Leadership campaign started as the remaining two candidates are both talking about a “no-deal” Brexit.

Here is a chart of the FTSE All-share Index for the previous 12 months:

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 30 June 2019.

Please note that now we have a ten year track record I’m quoting long-term returns over 5 & 10 years rather than 3 & 5 years.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 30 June 2019 |

One year Performance to 30 June 2019 |

|---|---|---|

| Cautious Portfolio | +3.2% | +3.9% |

| Average Mixed Investment fund (20-60% shares) | +2.9% | +3.0% |

| Balanced Portfolio | +4.7% | +4.2% |

| Average Mixed Investment fund (40-85% shares) | +4.2% | +3.6% |

| Adventurous Portfolio | +5.4% | +4.4% |

| Average Flexible Investment Fund | +3.8% | +2.7% |

| FTSE all share index | +3.2% | +0.5% |

| FTSE world index exUK (£) | +6.7% | +11.0% |

| IBOX Gilt Index | +1.4% | +5.2% |

Long-term Performance

| Parmenion Portfolio/Index | Five year Performance to 30 June 2019 |

Ten year Performance to 30 June 2019 |

|---|---|---|

| Cautious Portfolio | +30.5% | +125.5% |

| Average Mixed Investment fund (20-60% shares) | +25.9% | +84.4% |

| Balanced Portfolio | +45.8% | +149.4% |

| Average Mixed Investment fund (40-85% shares) | +37.3% | +120.4% |

| Adventurous Portfolio | +59.7% | +184.5% |

| Average Flexible Investment Fund | +37.8% | +121.5% |

| FTSE all share index | +35.8% | +167.1% |

| FTSE world index exUK (£) | +91.5% | +274.4% |

| IBOX Gilt Index | +32.4% | +71.2% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio gained +3.2% over the second quarter out-performing its benchmark (the average mixed investment (20-60% shares) fund) which gained +2.9%. All asset classes enjoyed strong gains apart from UK Commercial property, which was flat.

One fund disappointed and fell -4.3% over the month, which was a specialist property fund investing in European commercial and residential property where a freeze in rents announced by the Berlin regional government reduced valuations significantly. On a more positive note, all markets enjoyed decent gains along with fixed-interest securities which continued to firm. This burst of strength was due to expectations that interest rates around the world are going to be reduced, led by the US.

No portfolio changes were made last quarter.

Balanced Portfolio

The Balanced Portfolio gained +4.7% over the second quarter out-performing its benchmark (the average mixed investment (40-80% shares) fund) which gained +4.2%. All asset classes enjoyed strong gains apart from UK Commercial property, which was flat.

One fund disappointed and fell -3.8% over the quarter, which was a specialist property fund investing in European commercial and residential property where a freeze in rents announced by the Berlin regional government reduced valuations significantly. On a more positive note, our Asian and Emerging market investments made handsome gains, with each fund up +6.0% and +9.5% over the quarter.

Globally, all markets enjoyed decent gains along with fixed-interest securities which continued to firm. This burst of strength was due to expectations that interest rates around the world are going to be reduced, led by the US.

No portfolio changes were made last quarter.

Adventurous Portfolio

The Adventurous Portfolio gained +5.4% over the second quarter, out-performing its benchmark (the average Flexible fund) which gained +3.8%. Most of the funds we use enjoyed strong gains.

One fund disappointed and fell -3.8% over the quarter, which was a specialist property fund investing in European commercial and residential property where a freeze in rents announced by the Berlin regional government reduced valuations significantly. On the other hand, our Asian and Emerging market investments made handsome gains with each fund up +6.0% and +9.5% over the quarter.

Globally, all markets enjoyed decent gains along with fixed-interest securities which continued to firm. This burst of strength was due to expectations that interest rates around the world are going to be reduced, led by the US.

No portfolio changes were made last quarter.

OUTLOOK

Investors are perplexed by the fact that bond markets have rallied hard as well as equity markets. This is an odd combination, as usually a strong bond market points to recession (as people buy defensive bonds when bad times are expected). A recession would be bad for equity markets. A global economic slowdown has occurred, and markets are betting that interest rates will fall round the world and stop this becoming recession.

Whatever the outcome, all asset prices have risen to roughly where they were at the all-time peak last year, and in my view have got ahead of events. I now expect a pause or a pull-back. Central bankers need to follow through with interest rate cuts or there will be disappointment.

A trade deal between the US and China could be the thing that keeps momentum going.

My favoured market is still the UK, which although not as cheap as it was is still great value. I’ve come round to the view that any Brexit resolution would be good for the UK market due to the removal of uncertainty, but a “bad Brexit” would benefit portfolios the most, due to positive currency effect a weaker Sterling would bring to overseas equity valuations.