Markets made strong gains in the second quarter of the year, recovering their poise after a big sell-off in the first quarter. The UK market was the star performer, rising by +9.2% in three months. However, this was from a very depressed position. Returns in the UK were driven by exchange rate factors. As Sterling fell in value the stock market surged, as the value of our overseas earnings was boosted.

Developed markets (Asia excepted) made decent gains, with Europe and the US to the fore. The well know US ‘tech stocks recovered, having been previously sold-off due to concerns about the security of their customers data.

In Asia and the Emerging Markets sentiment has turned sour due to the Trump inspired trade war. This has hardly had an impact in the US but most Asian and Emerging Markets have fallen in value. The Chinese market has fallen by around 20%. The markets clearly have decided who will win the trade war, and it won’t be China.

The UK commercial property market has continued to make stable gains in recent months, mainly

boosted by significant outperformance from the industrial and distribution sectors. Retail remains the worst performing area of the market. The total return from UK commercial property averaged +1.3% over the quarter.

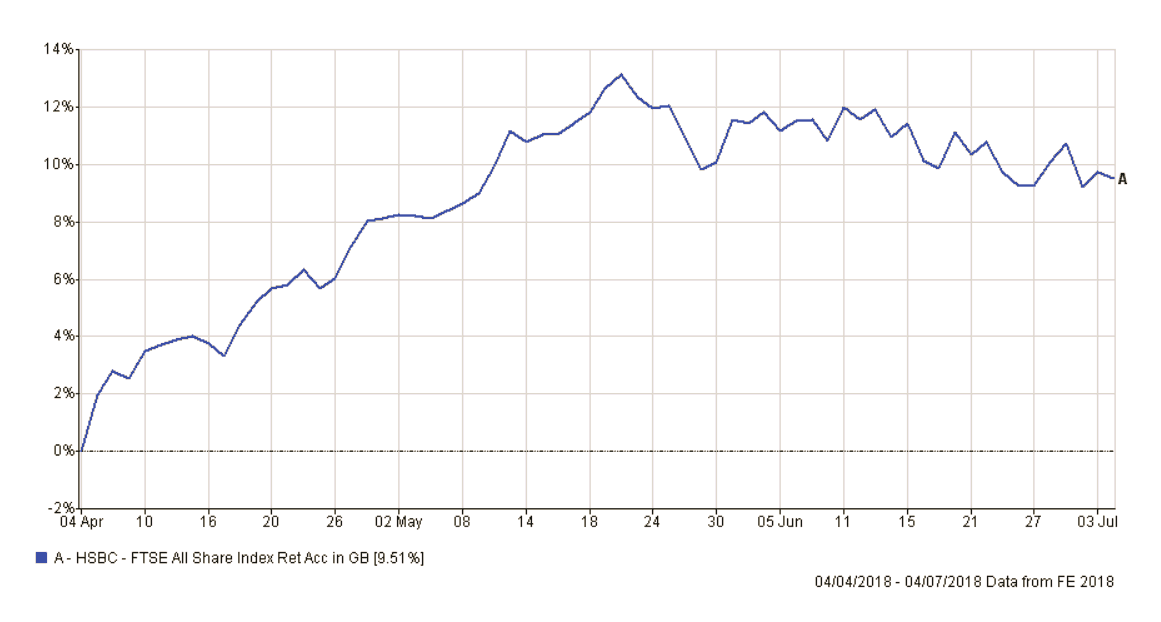

Here is a chart of the FTSE all-share Index for the last three months:

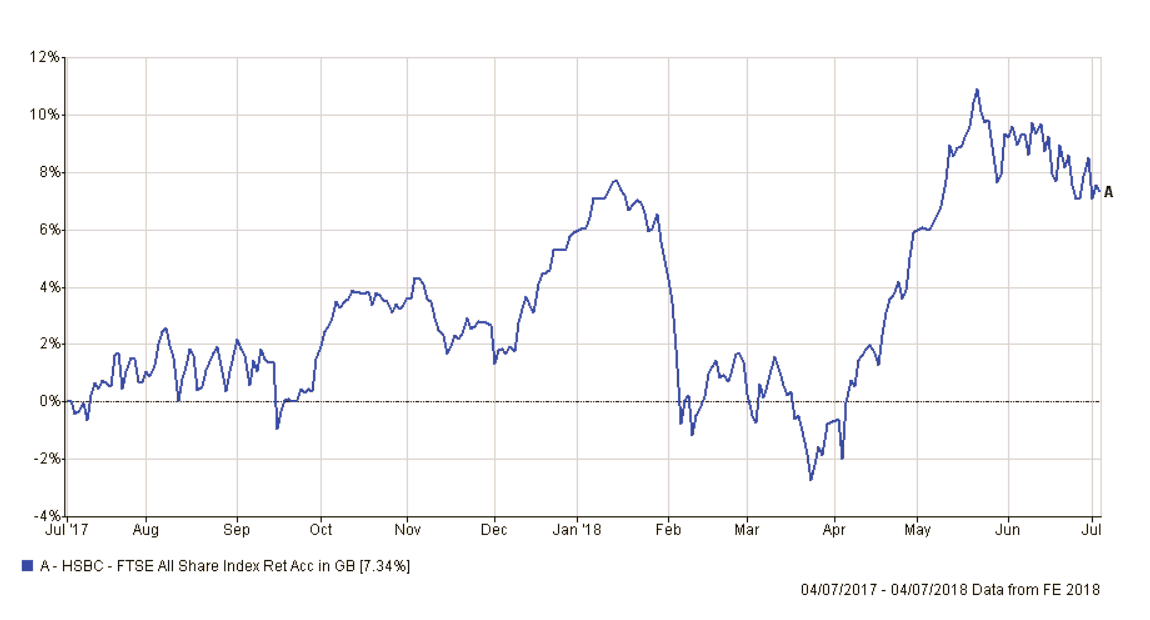

…and the last 12 months:

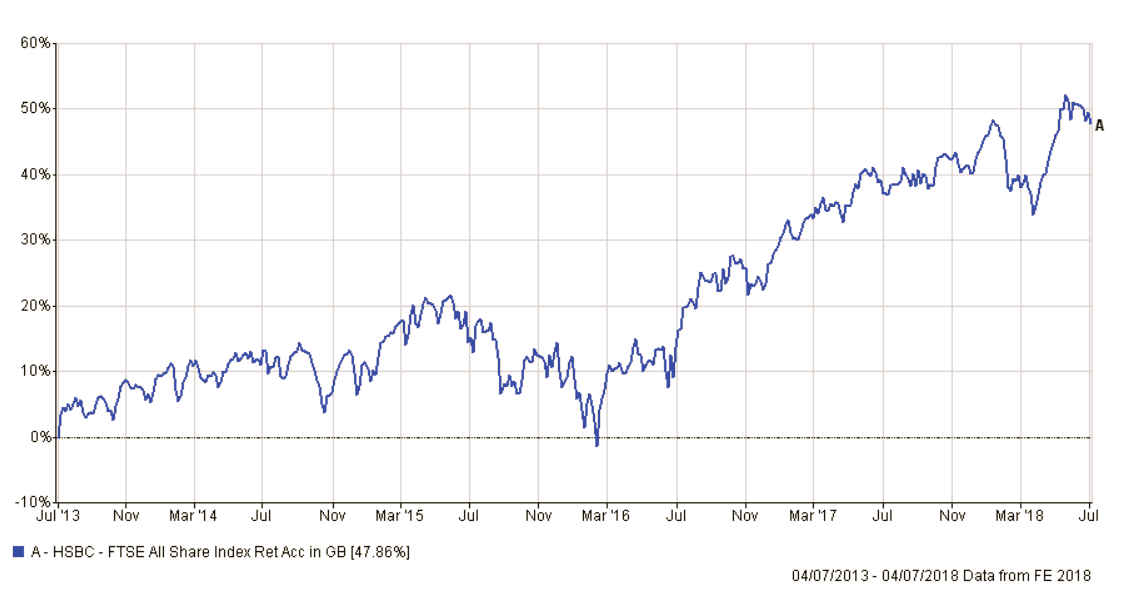

…and the previous 5 years:

Portfolio performance

I enclose tables showing the performance of all portfolios over various time periods to the 30 June 2018.

Short-term performance

| Parmenion Portfolio/Index | One month Performance to 30th June 2018 |

One year Performance to 30th June 2018 |

|---|---|---|

| Cautious Portfolio | +3.0% | +4.0% |

| Average Mixed Investment fund (20-60% shares) | +2.8% | +2.4% |

| Balanced Portfolio | +5.5% | +8.2% |

| Average Mixed Investment fund (40-85% shares) | +4.8% | +4.8% |

| Adventurous Portfolio | +5.0% | +7.9% |

| Average Flexible Investment Fund | +4.3% | +5.0% |

| FTSE all share index | +9.2% | +9.0% |

| FTSE world index exUK (£) | +7.0% | +9.4% |

| IBOX Gilt Index | +0.1% | +2.0% |

Long-term performance

| Parmenion Portfolio/Index | Three year Performance to 30th June 2018 | Five year Performance to 30th June 2018 |

|---|---|---|

| Cautious Portfolio | +17.5% | +38.8% |

| Average Mixed Investment fund (20-60% shares) | +16.3% | +30.8% |

| Balanced Portfolio | +28.9% | +52.2% |

| Average Mixed Investment fund (40-85% shares) | +24.0% | +42.3% |

| Adventurous Portfolio | +38.2% | +69.1% |

| Average Flexible Investment Fund | +25.3% | +44.6% |

| FTSE all share index | +31.6% | +52.7% |

| FTSE world index exUK (£) | +55.8% | +89.4% |

| IBOX Gilt Index | +15.2% | +28.9% |

Cautious Portfolio

The Cautious Portfolio gained +3.0% over the second quarter out-performing the its benchmark (the average mixed investment (20-60% shares) fund) which gained +2.8%. All our equity investments made strong gains with some funds making double figure returns. Luckily, the small component we have allocated to Asia also generated a small positive return too. Fixed-interest securities and our cash holdings were a modest drag on performance.

Over the previous quarter we sold small positions in two UK property funds and recycled the money into the European commercial property markets, as I felt the prospects for growth were better in Frankfurt and Paris than in London. We also reduced exposure to the FT All Share Index (accessed using a tracker fund) switching into a fund that tracks the FT250 index. This was done to broaden our exposure to mid-sized companies which historically have grown faster than their larger brethren.

Balanced Portfolio

The Balanced Portfolio gained +5.5% over the second quarter, out-performing its benchmark (the average mixed investment (40-80% shares) fund) which gained +4.8%. All our equity investments made strong gains with some funds just making double figure returns. Our UK growth investment managers led the charge with Liontrust Special Situations adding +10.6%.

The only equity fund that lost money over the quarter was Fidelity Emerging Markets which was down – 2.5%. Fixed-interest securities and our cash holdings were a modest drag on performance.

Over the previous quarter we reduced exposure to the FT All Share Index (accessed using a tracker fund) switching into a fund that tracks the FT250 index. This was done to broaden our exposure to mid-sized companies which historically have grown faster than their larger brethren.

Adventurous Portfolio

The Adventurous Portfolio gained +5.0% over the second quarter, out-performing its benchmark (the average Flexible fund) which gained +4.3%. All our equity investments made strong gains with some funds making double figure returns, but the little cash we held and our modest weighting in fixed interest securities held us back.

Star performers were Jupiter European; up +11.8% and Liontrust Special Situations; up +10.6%. The only equity fund that lost money over the quarter was Fidelity Emerging Markets which was down -2.5%.

Over the previous quarter we sold our FT All Share tracker fund switching into a fund that tracks the FT250 index. This was done to broaden our exposure to mid-sized companies which historically have grown faster than their larger brethren.

Outlook

The trade war is hoting up with a huge list of imports now facing extra tax charges in both the US and China. The markets have already decided who the winner of this financial battle will be, and it won’t be China. The main Chinese stock index is now off -23%, whereas the US market has only fallen by around three or four percent.

Many investors are worried about some markets suffering collateral damage – such as Japan and Germany. These great exporting nations rely on China for components in their supply chain and as a result their markets are coming under pressure.

Consumers will also pay a high price. Lots of cheap gadgets are manufactured in China and a 25% import tax will hit some consumers hard.

A number of indicators are signalling that economic growth is slowing. The oil price fell by -6.9% last week. This was the largest percentage fall since February 2016. The sharp move reflected widespread weakness in commodity markets as trade tensions between the world’s two biggest economies went up a notch.

China is the biggest consumer of almost all metals, many of which are turned into products for export. These are also falling in value as the Chinese economy slows. This economy is now so large that if China sneezes, we all catch a cold.

I maintain my cautious stance.