February started with a bang of the wrong sort – a major sell-off in markets. This entered official “correction” territory, with global markets falling by 10%. Fortunately, this was swiftly followed by a sharp recovery – at least in Global markets. Unfortunately, the UK equity market has remained depressed with the result that the fall over the month was a net reduction of -3.2%, whereas Global markets fell by only -0.7%.

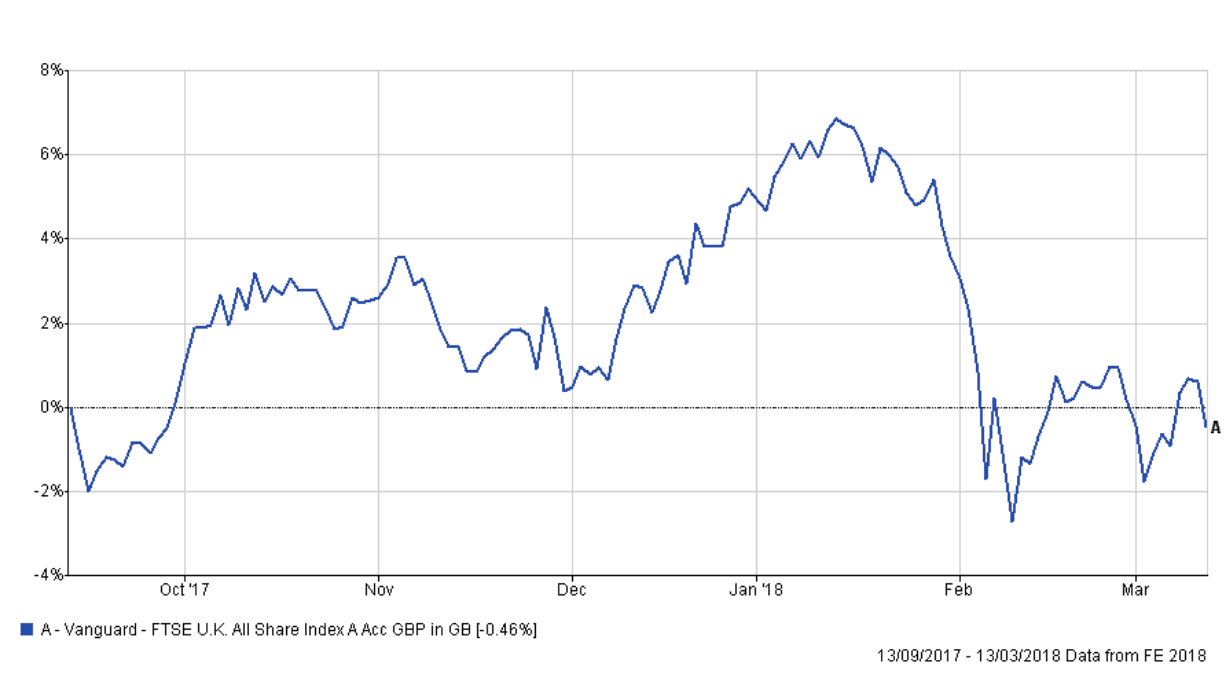

The UK market is notable for its lack lustre performance (see chart below). This reflects the fact that the UK is the world’s least favoured Western market due to Brexit and political uncertainty combined with the headwinds of a stronger GB£.

The markets were spooked by a rise in labour wage rates in the US, which if maintained would feed through into higher inflation. As it was, the US market was anticipating three small increases in interest rates in 2018, but four increases now look to be more likely.

Another factor that caused the large sell-off, was simply that markets (and especially the US market) had risen very quickly – maybe too quickly – and was trading at elevated levels. Its not surprising that investors were quick to take profits.

Finally, talk of a trade war, due to comments by Trump regarding US tariffs on imported steel and aluminium, caused additional nervousness.

Here is a chart of the FTSE 100 share Index for the last six months:

…and the last five years, which puts this into perspective:

UK Fixed-interest securities were also weak due to expectations (reinforced by comments from the Bank of England) that interest rates were more likely to rise.

UK commercial property flatlined after what has been a decent 12-month period, as woes in the Nation’s High Streets fed into a feeling of caution.

Portfolio Performance

I enclose tables showing the performance of all portfolios over various time periods to the end of January 2018.

Short-term performance

| Parmenion Portfolio/Index | One month Performance to 28 February 2018 |

One year Performance to 28 February 2018 |

|---|---|---|

| Cautious Portfolio | -1.1% | +4.3% |

| Average Mixed Investment fund (20-60% shares) | -1.3% | +3.4% |

| Balanced Portfolio | -1.4% | +7.7% |

| Average Mixed Investment fund (40-85% shares) | -1.6% | +5.3% |

| Adventurous Portfolio | -1.5% | +9.3% |

| Average Flexible Investment Fund | -1.5% | +6.6% |

| FTSE all share index | -3.2% | +4.4% |

| FTSE world index exUK (£) | -0.7% | +7.6% |

| IBOX Gilt Index | +0.2% | -1.2% |

Long-term performance

| Parmenion Portfolio/Index | Three year Performance to 28 February 2018 |

Five year Performance to 28 February 2018 |

|

|---|---|---|---|

| Cautious Portfolio | +14.3% | +36.0% | |

| Average Mixed Investment fund (20-60% shares) |

|

+28.9% | |

| Balanced Portfolio | +23.7% | +46.2% | |

| Average Mixed Investment fund (40-85% shares) | +20.4% | +40.9% | |

| Adventurous Portfolio | +34.3% | +62.8% | |

| Average Flexible Investment Fund | +22.6% | +42.6% | |

| FTSE all share index | +18.2% | +42.1% | |

| FTSE world index exUK (£) | +47.5% | +89.0% | |

| IBOX Gilt Index | +10.9% | +23.4% |

Portfolio review

All portfolios fell in value during February as the UK market was very weak and fixed-interest securities also suffered modest losses.

Cautious Portfolio

The Cautious Portfolio lost -1.1% in February marginally out-performing the its benchmark (the average mixed investment (20-60% shares) fund) which fell by -1.3%.

All our UK equity funds lost around -1.5% over the month, but modest gains in overseas markets helped to offset this.

No changes were made to the portfolio this month.

Balanced Portfolio

The Balanced Portfolio lost -1.4% in February, marginally out-performing its benchmark (the average mixed investment (40-80% shares) fund) which lost -1.6%.

Our UK equity funds lost around -1.5% over the month. Losses were compounded by some weak overseas markets (eg Japan) but offset by gains elsewhere, such as European markets.

No changes were made to the portfolio this month.

Adventurous Portfolio

The Adventurous Portfolio lost -1.5% in February in-line with its benchmark (the average Flexible fund) which also lost -1.5%.

Some of our UK equity funds lost around -1.5% over the month. Losses were compounded by some weak overseas markets (eg Japan) but offset by gains elsewhere, such as European and Emerging markets.

No changes were made to the portfolio this month.

Outlook

The recent fall in global markets was a reminder that the value of investments can fall as well as rise. Its been around two years since any major market has fallen by over 1.0% in a day. Volatility is back and I expect more of it during 2018 as investors cope with a slow tightening in monetary policy as the interest rate environment normalises.

The UK market looks especially sad as we have suffered an -8.2% fall from top to bottom without any bounce-back. Unfortunately, a toxic mix of a stronger GB£, weak economic growth, Brexit and political uncertainty have all taken its toll, rendering the UK as the world’s least favoured western market by the global investing community.

I’m mulling reducing exposure to the domestic market, but all the bad news is in the price and the UK market now looks like good value, so I will probably maintain our position for the time being.