15 June 2018

Investment Report: June 2018 – Maintaining momentum

;)

Important announcement

Before we look back to May, I want to take this opportunity to inform you that, in line with reporting trends, from July onwards we will produce our Investment Report on a quarterly rather than monthly basis.

June 2018 (for May 2018)

Global markets continued to push ahead during May maintaining the momentum established in April. The FTSE World index gained +3.7% in May. This positivity seemed somewhat strange as investors have had to grapple with the threat of trade wars and the possibility of higher interest rates in the US.

Some of the upward move was a recovery is the share price of leading US technology companies, which produced pleasing results in this quarter’s results season.

The UK market pushed on up, with the FT100 share index touching an all-time high of 7,877 at one point and gaining +2.7% during May. As usual, this market strength was driven by Sterling’s continued weakness on the foreign exchanges. This was explained partly by renewed US$ strength and partly as our Brexit negotiations appear to be creating political turmoil in parliament.

The UK commercial property market posted moderate returns during May. The monthly return was the lowest since October 2016, as signs of a slowdown in the retail and office sectors became more apparent. Industrials continued to outperform the wider market as increased demand for logistics space offset the tale of woe that is the Nation’s High Streets.

Retail sales had their largest fall since 2005. The 4.2% slump, in comparison to the same month last year, was blamed on unpredictable weather. But increasing pressure from on-line sales, slow wage growth and higher costs are having a detrimental effect on retailers.

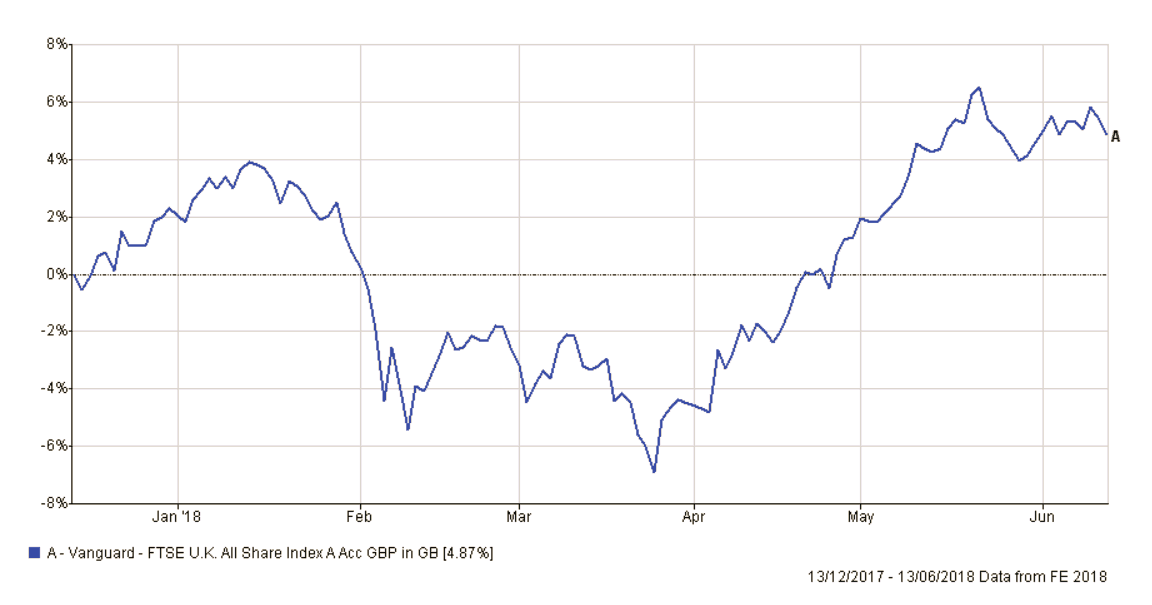

Here is a chart of the FTSE all-share Index for the last six months:

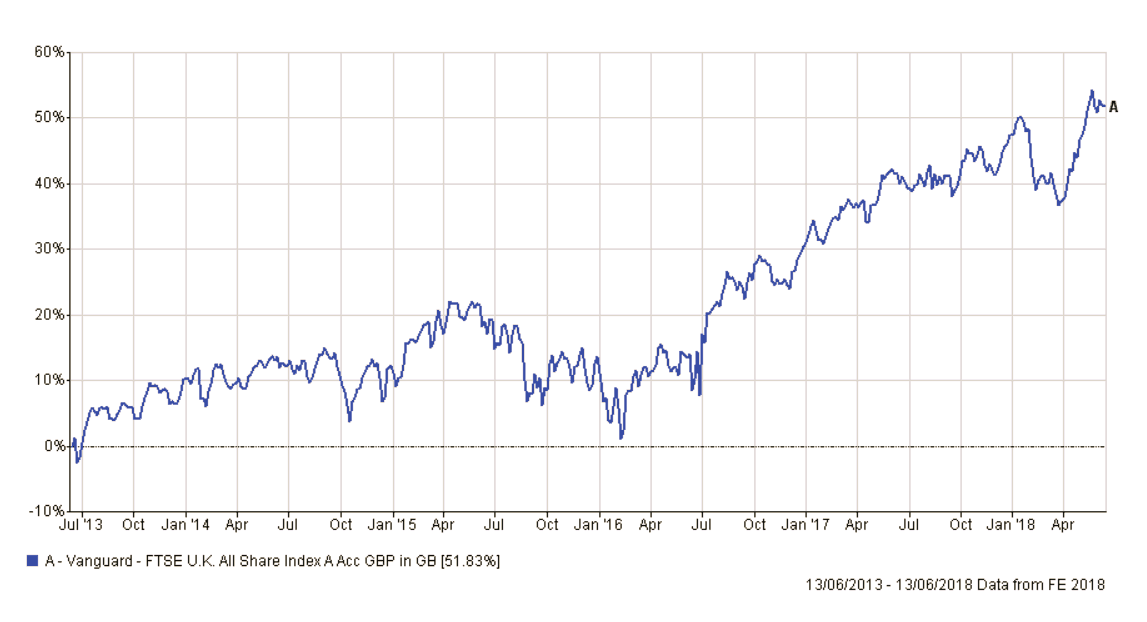

…and the last five years, which puts this into perspective:

Portfolio performance

I enclose tables showing the performance of all portfolios over various time periods to the 30 May2018.

Short-term performance:

| Parmenion Portfolio/Index | One month Performance to 31st May 2018 |

One year Performance to 31st May 2018 |

|---|---|---|

| Cautious Portfolio | +1.2% | +3.3% |

| Average Mixed Investment fund (20-60% shares) | +0.9% | +2.0% |

| Balanced Portfolio | +2.3% | +6.9% |

| Average Mixed Investment fund (40-85% shares) | +1.9% | +4.2% |

| Adventurous Portfolio | +2.3% | +6.9% |

| Average Flexible Investment Fund | +1.6% | +4.8% |

| FTSE all share index | +2.7% | +6.5% |

| FTSE world index exUK (£) | +3.7% | +8.8% |

| IBOX Gilt Index | -1.8% | -0.5% |

Long-term performance

| Parmenion Portfolio/Index | Three year Performance to 31st May 2018 |

Five year Performance to 31st May 2018 |

|---|---|---|

| Cautious Portfolio | +14.5% | +34.6% |

| Average Mixed Investment fund (20-60% shares) | +13.5% | +26.7% |

| Balanced Portfolio | +25.2% | +47.9% |

| Average Mixed Investment fund (40-85% shares) | +19.6% | +38.1% |

| Adventurous Portfolio | +33.0% | +63.3% |

| Average Flexible Investment Fund | +20.6% | +39.2% |

| FTSE all share index | +24.2% | +45.4% |

| FTSE world index exUK (£) | +47.2% | +83.7% |

| IBOX Gilt Index | +13.8% | +26.6% |

Portfolio Review

All portfolios improved in May as positive investor sentiment continued. The US market enjoyed continued momentum as ‘tech stocks recovered in value. The UK market continued to strengthen as the GB Pound weakened further.

Cautious Portfolio

The Cautious Portfolio gained +1.2% in May, out-performing the its benchmark (the average mixed investment (20-60% shares) fund) which gained +0.9%. Our overseas investments performed especially well with one global fund up over 5.0% on the month. Fixed-interest securities were weak which detracted from returns.

This month we switched some funds from the main FT All-share index into the FT250 index. This subtle change (which boosts exposure to mid-sized companies) was done with the aim of improving long-term returns. We sold UK commercial property as the outlook for the retail sector is so difficult now and switched into European properties instead.

Balanced Portfolio

The Balanced Portfolio gained +2.3% in May, out-performing the its benchmark (the average mixed investment (40-80% shares) fund) which gained +1.9%. Our overseas investments performed especially well with our US exposure gaining +7.4% and European exposure over 5.0%. Fixed-interest securities were weak, which detracted from returns a little.

This month we switched some funds from the main FT All-share index into the FT250 index. This subtle change (which boosts exposure to mid-sized companies) was done with the aim of improving long-term returns.

Adventurous Portfolio

The Adventurous Portfolio gained +2.3% in May, out-performing its benchmark (the average Flexible fund) which gained +1.6%. Our overseas investments performed especially well with our US exposure gaining +7.4% and European exposure over 5.0%. Fixed-interest securities and emerging markets were weak, which detracted from returns marginally.

This month we switched some funds from the main FT All-share index into the FT250 index. This subtle change (which boosts exposure to mid-sized companies) was done with the aim of improving long-term returns.

Outlook

On 13th May, the US continued with its programme of raising interest rates. The FED funds rate nudged up another 0.25% increasing to 1.75%. You may be interested to note that the FED’s policy committee are forecasting a rate of 3.0% by the end of 2019. This may have implications of UK rates of interest as wide disparities in ’rates between western economies are unusual.

I have been surprised at how markets have collectively ignored Trump’s protectionist rhetoric and have come to the conclusion that investors simply ignore what Trump says.

Markets seldom react well to increases in rates of interest, but in the current scenario one could make the argument that this is a normalisation of the money markets after the Credit Crunch and is long overdue. Inflation still appears to be low and stable and globally corporate profits are strong. I’m cautiously optimistic.

Category: Investment Report, News