The fourth quarter of 2018 has been characterised by volatile markets brought about by a perception that economic growth may stall in the important US market.

The main headlines to note are:

- A gradual easing in global growth which affects Asia and Europe more than America.

- A steady tightening in global monetary conditions with further interest rate increases coming through in the US.

- Ongoing trade tensions between the US and China which is starting to bite in China, where the economy is now in recession.

- A shut-down in the US federal government which has further unsettled investors. This occurred due to stalled negotiations surrounding the building of Trump’s famous wall between the US and Mexico.

- Raised political tensions and uncertainty about the status of Britain’s exit from the EU.

I enclose a table demonstrating the investment returns achieved from the World’s main markets over the previous quarter and over 2018 as a whole.

| INDEX | COUNTRY | 2018 RETURN | 3 MONTH RETURN |

| S&P 500 | US | -7.6% | -14.2% |

| FTSE All Share Index | UK | -12.9% | -10.7% |

| NIKKEI 225 | Japan | -12.0% | -15.2% |

| FTSE EuroFirst 300 | Europe | -13.8% | -16.4% |

| MSCI Asia (ex-Japan) | Asia | -25.0% | -16.0% |

Here is a chart of the FTSE All-share Index for 2018 as a whole:

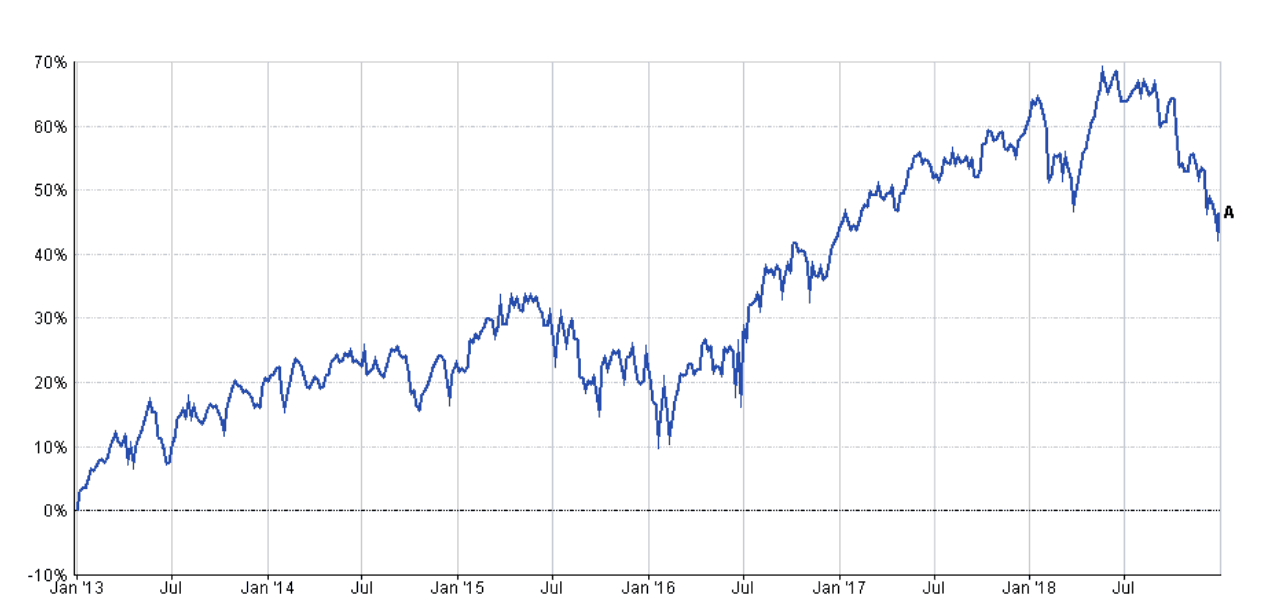

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 31 December 2018.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 31 December 2018 |

One year Performance to 31 December 2018 |

|---|---|---|

| Cautious Portfolio | -5.3% | -3.8% |

| Average Mixed Investment fund (20-60% shares) | -5.4% | -5.1% |

| Balanced Portfolio | -8.4% | -5.0% |

| Average Mixed Investment fund (40-85% shares) | -7.8% | -6.1% |

| Adventurous Portfolio | -9.1% | -7.1% |

| Average Flexible Investment Fund | -8.2% | -6.2% |

| FTSE all share index | -10.2% | -9.4% |

| FTSE world index exUK (£) | -10.9% | -2.6% |

| IBOX Gilt Index | +2.0% | +0.6% |

Long term performance

| Parmenion Portfolio/Index | Three year Performance to 31 December 2018 |

Five year Performance to 31 December 2018 |

|---|---|---|

| Cautious Portfolio | +10.5% | +24.6% |

| Average Mixed Investment fund (20-60% shares) | +12.1% | +19.0% |

| Balanced Portfolio | +17.2% | +35.0% |

| Average Mixed Investment fund (40-85% shares) | +16.5% | +25.4% |

| Adventurous Portfolio | +23.9% | +44.9% |

| Average Flexible Investment Fund | +18.0% | +26.3% |

| FTSE all share index | +19.4% | +22.1% |

| FTSE world index exUK (£) | +44.0% | +69.3% |

| IBOX Gilt Index | +13.3% | +30.6% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio lost -5.3% over the final quarter in-line with its benchmark (the average mixed investment (20-60% shares) fund) which lost -5.4%. All equity investments fell considerably as world markets tumbled, but lower-risk fixed income securities and cash holdings held their value, ameliorating losses.

Over the previous quarter we added to our holdings in UK equities buying a FTSE250 tracker fund, as UK shares seemed to be very cheap due to the unloved status of the UK market. We reduced our allocation to Corporate Bonds raising cash, over concerns that this asset class was over-valued and could be hit for six if there was a recession. Finally, we swapped Marlborough Multicap Income fund for Miton Multicap Income’ as the later seemed to be performing better in current market conditions.

Balanced Portfolio

The Balanced Portfolio lost -8.4% over the final quarter under-performing its benchmark (the average mixed investment (40-80% shares) fund) which lost -7.8%. All equity investments fell considerably as world markets tumbled, but lower-risk fixed income securities mostly held their value, ameliorating losses.

Over the previous quarter we added to our holdings in UK equities buying a FTSE250 tracker fund, as UK shares seemed to be very cheap due to the unloved status of the UK market. We reduced our allocation to Corporate Bonds raising cash, over concerns that this asset class was over-valued and could be hit for six if there was a recession. Finally, we swapped Marlborough Multicap Income fund for Miton Multicap Income’ as the later seemed to be performing better in current market conditions.

Adventurous Portfolio

The Adventurous Portfolio lost -9.1% over the last quarter, under-performing its benchmark (the average Flexible fund) which lost -8.2%. Our heavy international exposure hurt performance, especially exposure to European and US markets. We also suffered due to modest exposure to UK smaller company shares, which were very weak. The portfolio’s unusual position in fixed income securities helped steady the ship.

During the quarter we were active managers and;

- Sold our holding in Japan where economic recovery seems to be receding and bought UK equities as they are such good value.

- Switched Marlborough Multicap Income’ for Miton Multicap Income’ as the later was performing better at present.

- Bought additional UK equities using the cash in the portfolio when the FTSE 100 index fell below 7,000, as we thought the UK market cheap on a 5-year view.

OUTLOOK

Markets have had to face a difficult combination of slowing global growth, tightening credit conditions (particularly in America), trade tensions and general political upheaval. All these concerns have created an unfavourable backdrop for long-term investment, which is a shame as during 2018 most companies enjoyed record increases in profitability, which one would have thought would propel markets upwards.

At the present time investor sentiment has turned sour and confidence is lacking. However, this is reflected in valuations that are progressively becoming more attractive, which if combined with an improvement in the political and economic outlook could result in improved market performance later in 2019.

My strategy is to maintain a cautious allocation to risk investments in portfolios at the present time, whilst gradually increasing the weighting to those markets that have fallen the most. I therefore expect to be increasing our exposure to UK and Asian equities at some time in 2019.