16 April 2019

Investment Report First Quarter 2019

;)

After a dismal 2018 the first quarter of 2019 ushered in a welcome recovery. This change of tack was brought about by an announcement by the US Fed (The Federal Reserve Board or Central Bank) that they planned no more increases in interest rates due to concerns that the US economy was starting to falter. This policy reversal was welcomed by markets which rapidly appreciated in value, led by the US market.

Other headlines of note were:

A continued easing in global growth, especially in Europe where political tensions in the UK and Italy have damaged sentiment. Europe is also a significant exporter of manufactured products to China, and the slowdown in China has had an adverse impact on the region’s exporting companies.

Trade tensions between the US and China continue, with a trade deal proving to be elusive. This has resulted in manufacturing output falling in China with a knock-on effect that China is now buying fewer imports from Europe and America.

Finally, and unsurprisingly, ongoing political tensions continue in the UK due to our inability to exit the EU in an orderly manner. However, it is worth mentioning that Sterling has found support on the foreign exchanges since it was decided by Parliament that we would not leave the EU without a trade deal.

Here is a chart of the FTSE All-share Index for the previous 12 months:

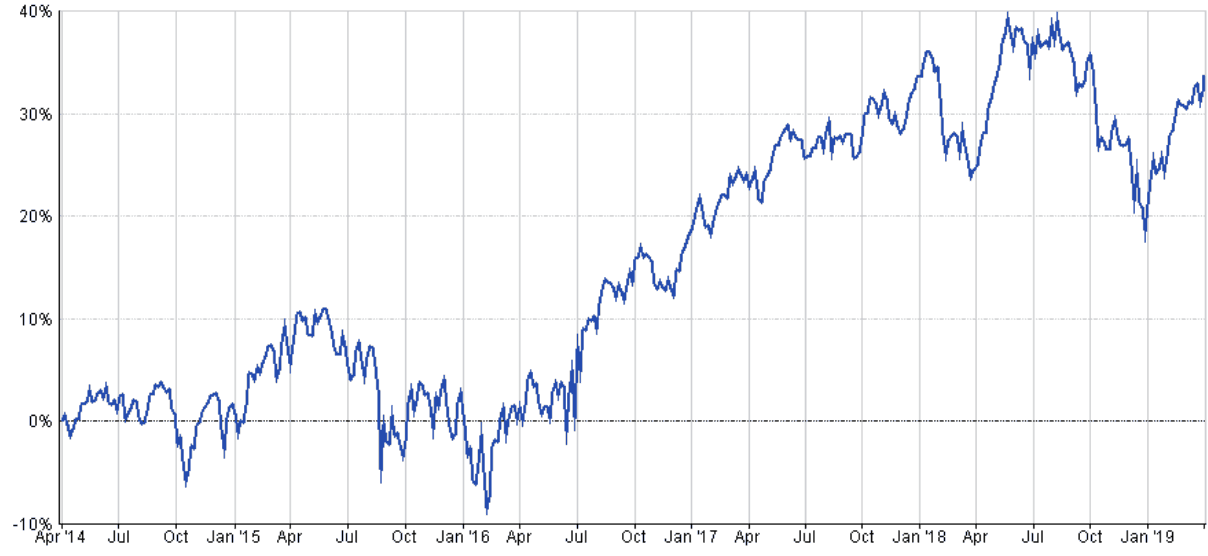

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 31 March 2019.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 31 March 2019 |

One year Performance to 31 March 2019 |

|---|---|---|

| Cautious Portfolio | +5.4% | +3.7% |

| Average Mixed Investment fund (20-60% shares) | +4.9% | +2.8% |

| Balanced Portfolio | +6.9% | +5.0% |

| Average Mixed Investment fund (40-85% shares) | +6.4% | +4.3% |

| Adventurous Portfolio | +7.8% | +4.0% |

| Average Flexible Investment Fund | +6.3% | +3.2% |

| FTSE all share index | +9.4% | +6.3% |

| FTSE world index exUK (£) | +9.4% | +11.4% |

| IBOX Gilt Index | +3.5% | +3.9% |

Long term performance

| Parmenion Portfolio/Index | Three year Performance to 31 March 2019 |

Five year Performance to 31 March 2019 |

|---|---|---|

| Cautious Portfolio | +16.7% | +29% |

| Average Mixed Investment fund (20-60% shares) | +17.1% | +24.0% |

| Balanced Portfolio | +24.9% | +41.6% |

| Average Mixed Investment fund (40-85% shares) | +24% | +33.1% |

| Adventurous Portfolio | +31.8% | +53.2% |

| Average Flexible Investment Fund | +25.8% | +34.4% |

| FTSE all share index | +31.3% | +34.4% |

| FTSE world index exUK (£) | +52.8% | +83.9% |

| IBOX Gilt Index | +11.5% | +32.1% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio gained +5.4% over the first quarter out-performing its benchmark (the average mixed investment (20-60% shares) fund) which gained +4.9%. All asset classes enjoyed strong gains apart from UK Commercial property, which flat-lined on Brexit concerns. All Western stock markets enjoyed double-digit gains, but Fixed Interest Securities also improved due to the improved outlook for global monetary policy.

Over the previous quarter we sold a long-term holding in Artemis Global Income switching into a low-cost global equity tracker instead.

Balanced Portfolio

The Balanced Portfolio gained +6.9% over the first quarter out-performing its benchmark (the average mixed investment (40-80% shares) fund) which gained +6.4%. All asset classes enjoyed strong gains apart from UK Commercial property, which flat-lined on Brexit concerns. All Western stock markets enjoyed double-digit gains, but Fixed Interest Securities also improved due to the improved outlook for global monetary policy.

Over the previous quarter we added to our holding in the HSBC FTSE250 tracker fund using the remaining cash we had on deposit. UK shares continue to be cheap due to the unloved status of the UK market. This additional purchase was well timed as the UK market strengthened.

Adventurous Portfolio

The Adventurous Portfolio gained +7.8% over the last quarter, out-performing its benchmark (the average Flexible fund) which gained +6.3%. All the funds we use enjoyed strong gains. All Western stock markets enjoyed double-digit gains, but fixed interest securities also improved due to the improved outlook for global monetary policy.

Over the previous quarter we added to our holding in the HSBC FTSE250 tracker fund using the remaining cash we had on deposit. UK shares continue to be cheap due to the unloved status of the UK market. This additional purchase was well timed as the UK market strengthened.

OUTLOOK

Bond markets are now pointing to the possibility of a global recession. A slowdown is certainly underway, and this has made investors cautious, particularly after the recent rally in share prices which has probably reached its limit now. Technical indicators, like movement in the bond markets can be unreliable, but do flag up the need to be cautious.

I would be reluctant to make additional investments in international markets at present, but do feel that something like a trade deal between the US and China could light the blue touch paper, so to speak.

My favoured market is here in the UK, which is great value. Whatever the outcome of Brexit we host numerous successful global companies which will continue to thrive.

Whilst the global economy may be slowing, central bankers are wise to the issue, and are now on “standby” to do something about it.

Category: Investment Report, News