I spend plenty of time pondering what can go wrong in the world of investment – what could be the catalyst for a market downturn – but I must confess that a US inspired trade war was definitely not top of the list. Yet here we are, involved in a tit-for-tat war of rhetoric, much like the Russians and the UK Government. Will this rhetoric actually lead to action I wonder?

Against this backdrop you won’t be surprised to see that I am reporting disappointing investment returns this month. Our own FTSE All-share index fell by -1.8%, but this was by no means the worse market, as globally stocks were down -3.8% in Sterling terms as investors worried about the damage a full-blown trade war could cause to economies and profits.

The US market lead the way down with a fall of -3.5%. The US market had another issue to contend with; the fall of the FAANGs (Facebook, Apple, Amazon, Netflix and Google). The FAANGs represent the biggest US tech’ companies and they have all been struggling following the Facebook data debacle. The FAANGS have enjoyed stellar growth over the last few years and so investors will be quick to take profits at the first sign of trouble.

There was some good news in March – thoughts that we were heading for an inflationary boom have receded and this means that the value of Governments bonds (Gilts, US Treasuries and the like) improved in value.

UK Commercial property had a flat month in spite of bad news relating to some high-profile retail failures. Luckily the investment managers we use have limited exposure to the Nation’s High Streets where the outlook for retail properties is poor.

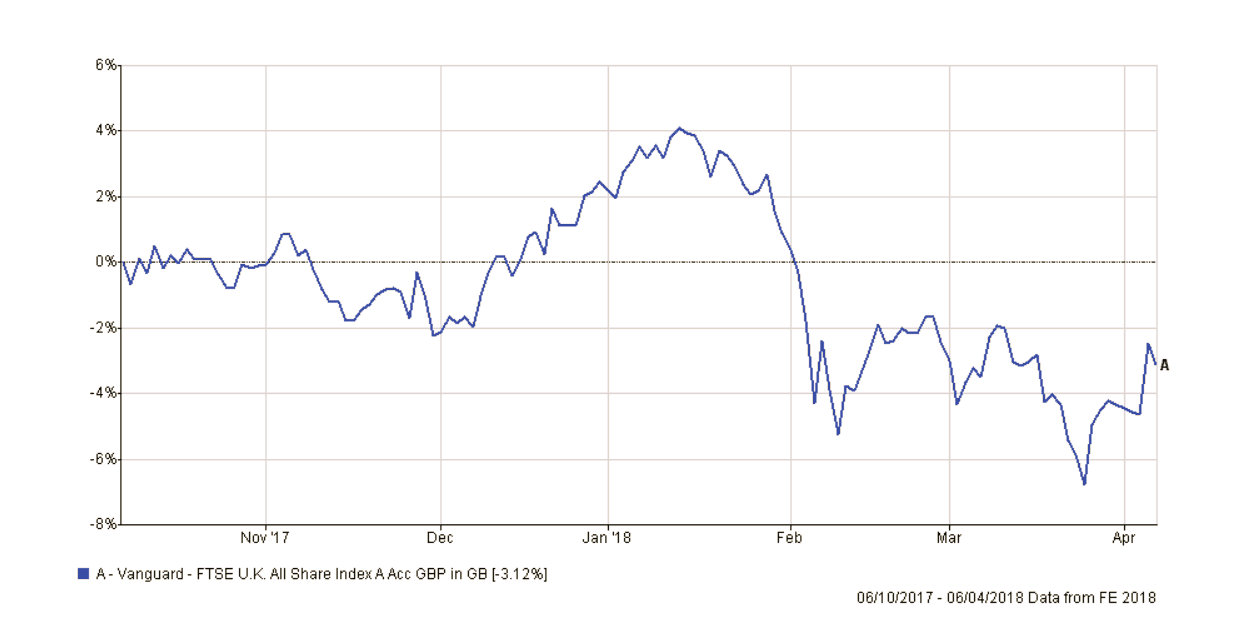

Here is a chart of the FTSE all-share Index for the last six months:

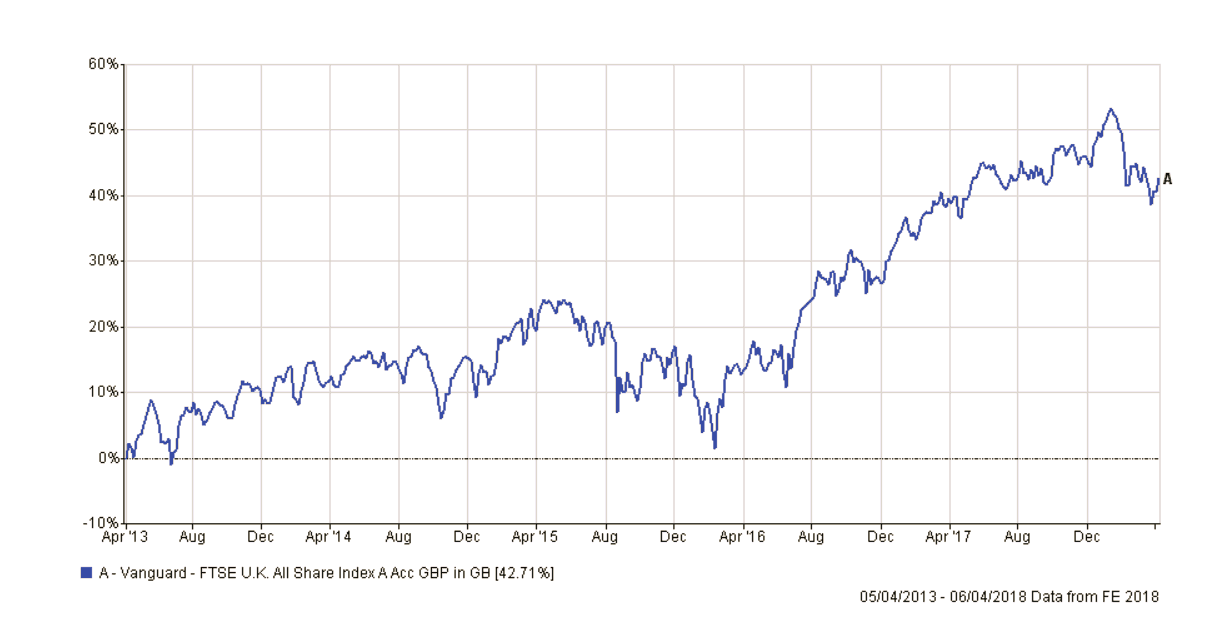

…and the last five years, which puts this into perspective:

Portfolio Performance

I enclose tables showing the performance of all portfolios over various time periods to the 31 March 2018.

Short-term performance

| Parmenion Portfolio/Index | One month Performance to 31 March 2018 |

One year Performance to 31 March 2018 |

|---|---|---|

| Cautious Portfolio | -1.0% | +2.4% |

| Average Mixed Investment fund (20-60% shares) | -1.7% | +0.8% |

| Balanced Portfolio | -1.5% | +5.0% |

| Average Mixed Investment fund (40-85% shares) | -2.6% | +1.5% |

| Adventurous Portfolio | -2.1% | +5.5% |

| Average Flexible Investment Fund | -3.0% | +2.3% |

| FTSE all share index | -1.8% | +1.2% |

| FTSE world index exUK (£) | -3.8% | +2.3% |

| IBOX Gilt Index | +2.0% | +0.4% |

Long-term performance

| Parmenion Portfolio/Index | Three year Performance to 31 March 2018 |

Five year Performance to 31 March 2018 |

|---|---|---|

| Cautious Portfolio | +12.3% | +32.8% |

| Average Mixed Investment fund (20-60% shares) | +11.0% | +24.9% |

| Balanced Portfolio | +20.1% | +42.2% |

| Average Mixed Investment fund (40-85% shares) | +15.4% | +34.8% |

| Adventurous Portfolio | +29.3% | +57.7% |

| Average Flexible Investment Fund | +16.6% | +36.1% |

| FTSE all share index | +18.6% | +37.5% |

| FTSE world index exUK (£) | +37.8% | +77.9% |

| IBOX Gilt Index | +10.8% | +23.8% |

Portfolio Review

All portfolios fell in value during March as global markets were weak due to concerns that there may be a US inspired trade war.

Cautious Portfolio

The Cautious Portfolio lost -1.0% in March out-performing the its benchmark (the average mixed investment (20-60% shares) fund) which fell by -1.7%. Global equities fell the most, but property, cash and fixed-interest investments helped to steady the ship.

No changes were made to the portfolio this month.

Balanced Portfolio

The Balanced Portfolio lost -1.5% in March, out-performing its benchmark (the average mixed investment (40-80% shares) fund) which lost -2.6%. Global equities fell the most, but some UK funds and our European investments made money, which helped offset the losses elsewhere.

In March we sold long standing funds managed by Stewart; Global Emerging Market Leaders and Asia Pacific Leaders. We feel the management group has lost its way following a change of management and a demerger at the firm. We opened a modest cash position too, pending opportunities elsewhere.

Adventurous Portfolio

The Adventurous Portfolio lost -2.1% in March out-performing its benchmark (the average Flexible fund) which lost -3.0%. Global equities fell the most. but some UK funds and our European investments made money, which helped offset the losses elsewhere.

In March we sold long standing funds managed by Stewart; Global Emerging Market Leaders and Asia Pacific Leaders. We feel the management group has lost its way following a change of management and a demerger at the firm. We opened a modest cash position too, pending opportunities elsewhere.

Outlook

Its ironic that during a period where business confidence globally has never been higher, that we have just endured the worst first quarter in markets for years. Its doubly unfortunate that our own UK market has lead the others down with a serious loss of -6.7%.

Globally we have had to face concerns regarding the re-emergence of inflation, a legislative crackdown on the US ‘tech companies and now the threat of a global trade war.

In my experience political events usually pass and often present a buying opportunity. We are unlikely to be buyers of the US ‘tech companies given their stratospheric valuations, but the main UK market is starting to look very attractive at sub-7,000 on the FT100 share index.